(May 18th, 2023)

By (Lorenzo Fruttero, Equity Analyst)

Edited by (Ascanio Cicogna, Head of Research)

A brief introduction

Can we still seek opportunities in the European real estate market? With higher interest rates, an increasing vacancy rate due to population decline and new habits, like freelance travellers and smart working, it is becoming highly difficult to identify a defined path in the sector.

Overview

To fight inflation central banks are increasing policy rates, this increase in interest rates has made it harder to get a mortgage; and lower demand means lower prices.

When values start to fall, borrowers will be in a more critic level of loan-to-value ratio and interest cover. Some assets, and likely some companies, will need injections of equity to rebalance the reduction of value, and return in the lender-imposed conditions. In the worst scenario, they could be forced to sell some assets to pay off the debt. To make matters worse, banks will be less inclined to grant loans during such volatile markets.

Nevertheless, commercial real estate makes up 9% of European bank loans and 15% of non-performing loans. That is notably less than US banks, which have 25% of their loans related to real estate, rising to 65 per cent for smaller regional banks (which have been the focus as of recent).

A cascading impact

Unfortunately, banks are not the only lenders, alternative sources of credit, such as asset management firms, wealth funds, and private equity firms, also provide a big source of financing for the sector. The problem is private debt funds don’t have to comply to strict regulations, unlike banks. However, according to some experts of the industry, it might not necessarily be a negative: they could meet the demand of loans and investments that banks no longer cover due to financial regulations.

The ECB urged regulators to develop policies that would prevent liquidity mismatches in funds, which own illiquid assets that take a long time to sell but promise to repay investors on demand. Fire sales of assets could amplify existing stress and have a chain effect on markets, endangering the stability of financial markets.

Measures proposed by the ECB include reducing the frequency at which investors can withdraw their money and requiring them to give longer notice, introducing longer minimum holding periods. Calling for consistent application of rules on property funds across the 20-country eurozone, the ECB said funds should also charge fees on investor redemptions and impose “gates” to limit further outflows.

However, we can still see positive fundamentals: during the 2008 Real Estate bubble the loan to value ratio was between 80 and 100, as financial institutions were basing their lending on excessively optimistic forecasts. European lenders would now rarely go beyond 60 per cent of a property’s value, making it less likely that the outstanding debt would end up exceeding the value of the property.

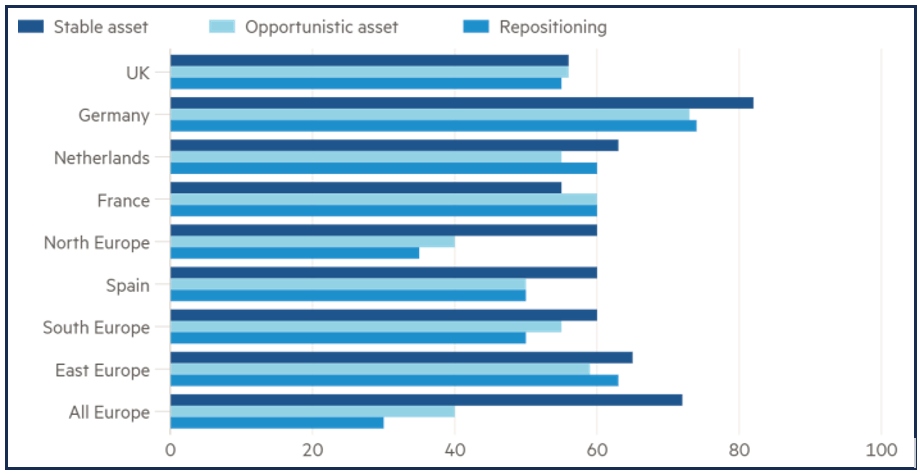

Figure 1: Max loan-to-value for commercial property by country(%)

Source: Bayes Business School

We also must consider that the market is split between robust appetite for attractive buildings that meet the latest environmental standards and little demand for other space. Prices for less desirable offices could fall, as developers will have to totally repurpose the buildings. Both the EU and the UK are phasing in new energy efficiency standards that will require heavy investment from the owners of old buildings.

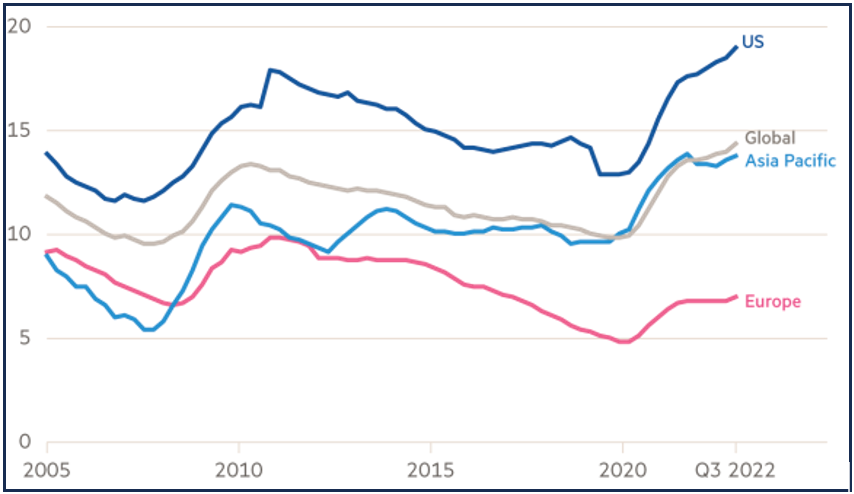

Another positive outlook regards the vacancy rate: the European one is well under the global benchmark. Nevertheless, it is historically lower than the others, also because of a more stagnant sector, especially compared to the US one.

Figure 2: Office vacancy rate (%)

Source: JLL

Conclusion

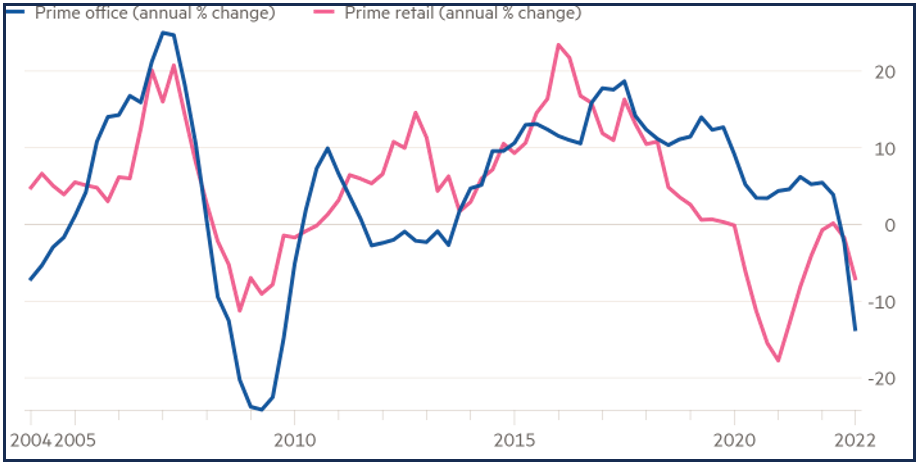

The European Real Estate Market is in a difficult period, with property prices already declining before the current crisis. If the situation doesn’t reverse, the outlook for the sector will become increasingly worse, even if central banks will interest rates hiking. A solution could come from policy makers, that could at least avoid unexpected market crashes by avoiding fire sales of assets.

Figure 3: EU commercial property prices

Source: JLL

Over the longer term we also must consider the worrying population decline, the increasing number of people in smart working, that no longer need to reside in the biggest economic centers, where the demand, and consequently prices, are particularly high.

Investment opportunities

While waiting for new national, or even European, regulations for the sector, the advice is to wait before any move in the industry in general. However, while the outlook on the market is currently clearly bearish, we can still seek opportunities in the biggest cities, especially in buildings that already meet the newest environmental and structural parameters.

Citations:

Italy re H2 year: Italia (no date) Cushman & Wakefield. Available at: https://www.cushmanwakefield.com/it-it/italy/insights/italy-re-h2-year (Accessed: 18 May 2023).

Oliver, J. (2023) European commercial real estate: The cracks are starting to show, Subscribe to read | Financial Times. Available at: https://www.ft.com/content/733a24d7-056d-4f02-8b20-8ba9f566e9f7?shareType=nongift (Accessed: 18 May 2023).

Gilchrist, K. (2023) Fears mount that Europe’s commercial real estate sector could be the next to fall, CNBC. Available at: https://www.cnbc.com/2023/04/14/fears-mount-european-commercial-real-estate-could-be-the-next-to-blow.html (Accessed: 18 May 2023).

Klasa, A. and Hammond, G. (2022) IMF warns funds with Illiquid Assets Pose Risk to financial stability, Financial Times. Available at: https://www.ft.com/content/a0556d64-985d-4b2f-ad83-8196afc89a51?shareType=nongift (Accessed: 18 May 2023).

Klasa, A. et al. (2022) UK property funds limit withdrawals as pension funds shift assets, Financial Times. Available at: https://on.ft.com/3LnFbfZ (Accessed: 18 May 2023).

Legal disclosure:

The projections or other information generated by BSTA regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. As such, BSTA does not assume any legal responsibility for actions that may have been taken by readers associated with any investment projections made by the members of BSTA. There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible.

Comments