Introduction

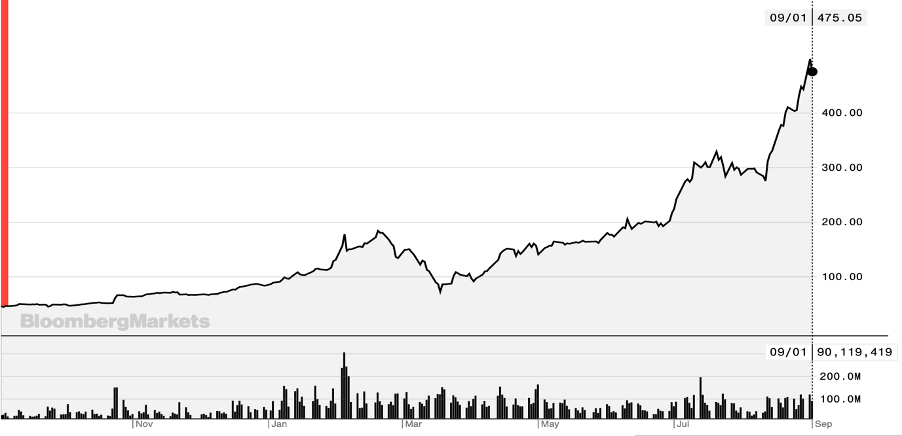

Before we start, let us take you to a small trip back to May 2019 when Tesla, the electric automaker and clean energy company, had a market capitalisation of $33B and its stock traded at below $200. At that time Tesla’s stock was marked as a risky and dangerous trading opportunity. Since then the company’s market value rose 12-fold to more than $400B with its stock trading at $2,150. At the time of writing, shares were trading at $508, because of a 5-for-1 stock spilt (on August 31st, the day of the stock split, Tesla’s priced went up by more than 14%). Faced with such a daunting appreciation in value, many investors are baffled by what is actually unfolding in front of their eyes.

Figure 1 Tesla Share Price, 1-year performance, source: Bloomberg

The million-dollar question that everyone is pondering about is whether we are we looking at a huge bubble or has Tesla actually upped its game and managed to convince investors that it can deliver on the market’s high expectations.

Buckle up as in the following series of articles we will dive in Tesla deeper than ever before, hoping that a full in-depth analysis of the company and the current stock market will yield some explanation of what is actually going on.

Tesla vs. Other Car-makers (Is it more valuable or overvalued)

Tesla is fundamentally a car maker company as this activity represents the majority of its operations. Therefore, in this analysis we will mostly consider its car-making business when trying to explain its appreciation.

Some people think about Tesla as a company gifted from God and of Elon Musk (with his controversial tweets) a genius like no other whose existence is beneficial to the whole world.

In July 2020, Tesla became the most valuable car company in the world, when it surpassed the market-cap of Toyota Motors (TM), however at a first glance neither innovation, nor Elon Musk seem to explain such an appreciation.

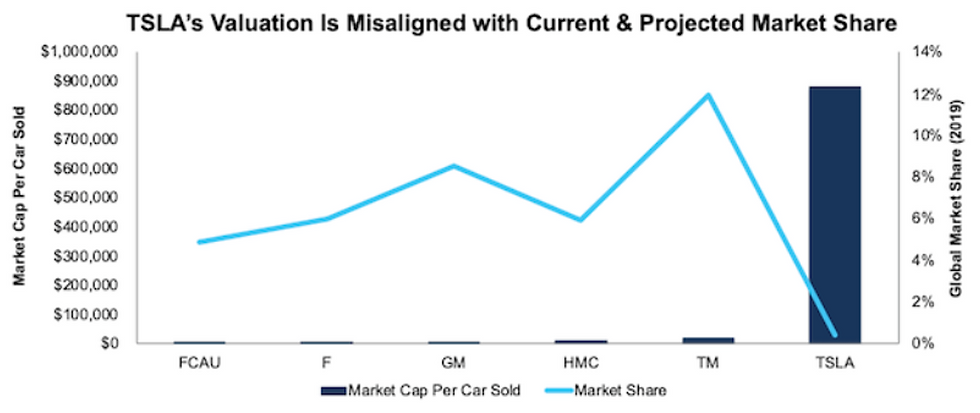

The following chart compares the market share of each car maker and market caps per car sold for Tesla, Toyota, Honda Motors (HMC), General Motors (GM), Ford (F), and Fiat Chrysler (FCAU).

Figure 2 Market Capitalization per vehicle sold, source: Newconstructs

So, we see here that Tesla, the most valuable (overvalued) automaker in the world, has less than 1% of the global market share while Toyota, the second most valuable car maker has about 12%. Some people tend to justify this valuation premium by claiming that Tesla has a huge first mover advantage in the EV industry, however, to many investors, this seems a weak argument that does not justify a market-cap per car sold of $880K, especially when compared to Toyota’s $19K (the second highest value in this list).

Tesla’s Profitability Questioned

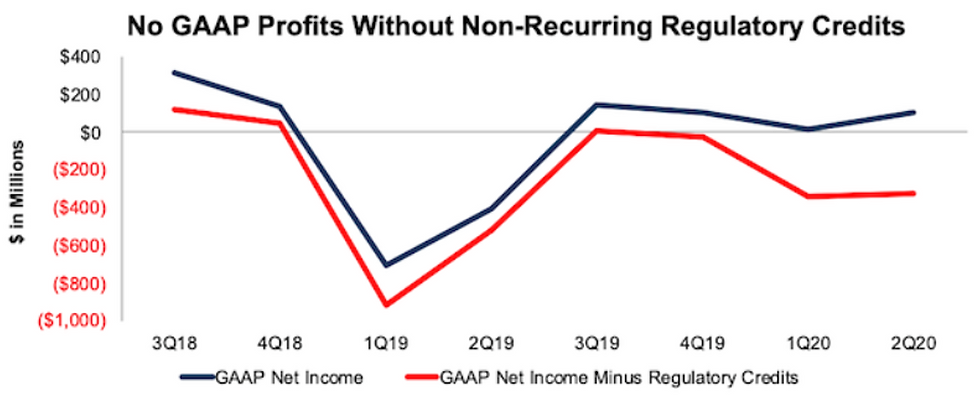

In the past three quarters, Tesla has managed to be profitable, a feat that it not so common but very welcome, especially for the fiduciaries that hype up very single thing Tesla does. Being profitable is a good sign, especially for Tesla which is struggling to meet higher demand for their vehicles due to their production restrictions, but is this spike in profitability coming from an increase in production capacity/efficiency or there is something else?

Believe it or not, Tesla’s recent profits are based on the sale of free regulatory credits to other gasoline automakers. Regulatory credits are basically permissions to pollute while producing cars. Many companies, on average, don’t meet regulatory requirements and therefore have to buy these credits from other companies. This is where Tesla gladly steps in and sells its regulatory credits (which it receives for free form the government on the basis of it being an electric vehicle maker) for large amounts.

In the second quarter of 2020, Tesla banked $428M in regulatory credits sales, while its net income was $104M.

Figure 3 Tesla's Income with and without regulatory credits sales, source: Newconstructs

The chart below shows Tesla’s Net Income in the previous quarters with and without the sales of regulatory credits. We see that this picture shows a whole new side of Tesla’s recent profitability. Without the sale of regulatory credits, Tesla wouldn’t have been profitable in the past 2 years. Nobody blames Tesla for selling these credits (any automaker would sell them if it had the possibility), the fundamental problem is that this is not a viable long-term strategy.

As other firms ramp up their production of EVs and earn more of these credits, then they will simply buy less from Tesla. For instance, in the first quarter of 2019 Fiat Chrysler announced that it expects to be compliant with regulatory requirements without the help of credits from Tesla by 2022. Without the profits from selling free regulatory credits, Tesla would likely suffer significant losses.

Tesla’s future market share in the EV market

As mentioned before, one of the bulls’ main argument for Tesla is that they are currently the largest EV maker (they have around 16% of the global market share in EVs), and that they have technologies that are years ahead of its competitors. Even though this might be true, for how long can they sustain this advantage?

Tesla officially sold 368,000 cars in 2019 and expects to sell 500,000 in 2020 while Volkswagen, General Motors, Toyota and Ford plan to sell around 3.1M (combined) EVs in 2025, which is significantly more than the most optimistic estimate for Tesla sales in 2025. Nevertheless, Elon Musk does not abandon his optimism as he expects $4M units produced in 2025. However, it seems safe to say that Tesla’s first mover advantage will be long gone by that time.

Tesla’s future Investments

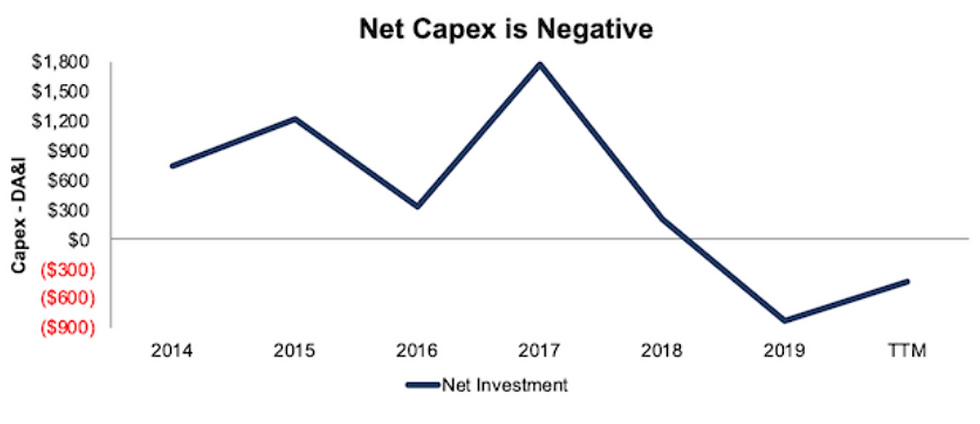

In its early stages Tesla has invested heavily in its operations for years, but recently it has reversed course and reduced investment (in order to hype up their profits and reduce dependence on outside capital). Tesla’s CAPEX (capital expenditure) has been about $1.3B in 2019 while its depreciation, amortisation and impairment has been about $2.2B. This implies a Net Investment of -$827M.

Figure 4 Tesla's Net Investment 2014-2020, source: Newconstructs

Even if Tesla didn’t reduce its investments into technology, their capex levels pale in comparison to other companies’ investments. For instance, Volkswagen group plans to spend $39B through 2024, General Motors plans $20B through 2025, Mercedes-Benz plans $10B through 2022 and Ford plans $11B through 2022.

In the firm’s 4Q19 earning’s call, when asked about guidance for capex in 2020, CEO Elon Musk said: “I don't know if we wanted to tell you, I don't think we want to say what our capex is going to be this year”.

In spite of having restricted funding, Tesla is keen on achieving its future projects such as building the Berlin Gigafactory, Austin Gigafactory and increasing production capacity for the model Y at the Shanghai Gigafactory. On top of that, they are developing the Tesla Semi, Cybertruck and Roadster.

Conclusion

As we saw so far, the story is much more complicated than it may appear at a first glance and there are many aspects we haven’t touched on yet. We will end the first part of Tesla’s story here but we’ll return real soon as we continue our journey by talking about the upcoming battery day, how tesla’s cars compare with other electric vehicles, the future of the self-driving car, noise traders, S&P 500 inclusion and different valuation methods to assess the true value of Tesla.

References:

· Tesla Q2 2020 update, available at https://ir.tesla.com/static-files/f41f4254-f1cc-4929-a0b6-6623b00475a6

· Bloomberg market data (https://www.bloomberg.com/markets)

Disclaimer

The ideas and opinions expressed in this report are the ones of the author and do not reflect in any way the ideas and opinions of Bocconi University. This report is intended for academic purposes only and is not intended to be an investment advice and thus should not be interpreted as such. Reliance of the information contained in this paper is at the sole discretion and risk of the reader.

Download the PDF Version of the article:

留言