Edited by (Francesco Corbellini, Head of articles)

source: Autore: Tim Hammond / No10 Downing Stree

Only a couple of days after Liz Truss was officially appointed as Prime Minister of the UK, it was revealed that Queen Elizabeth II had died. Her passing, and the several days of morning that came with it, kick-started Truss’ tumultuous start to her premiership.

After the period of mourning, on September 23rd, Kwasi Kwarteng – UK chancellor of the exchequer – announced a plan for £45bn worth of unfunded tax cuts, Britain’s largest tax cut since 1972, with the goal of driving economic growth by forcing businesses to invest while also simply helping “ordinary” people with the high gas prices coming up this winter according to Liz Truss herself.

Though the intention was seemingly justifiable, the plan backfired quite rapidly. The pound as well as gilts – which are UK government bonds – across maturities sold off very quickly due to decreased confidence as a result of an uncertain economic outlook. And, on the 26th of September, the pound reached a record low against the dollar due to increased supply of the pound as a result of its sell-off. The sell-off of the gilts also caused pension funds to be at risk of insolvency

This had a ripple effect on financial markets globally which had already been affected by concerns over interest rates rises. On the 27th of September, the S&P 500 reached its lowest level since November 2020, NASDAQ also saw a decline of 0.6%, and thus this plan was evidently accompanied by a fair amount of critique and panic.

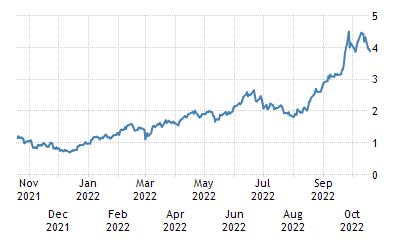

In order to restore order in the pension funds market, the Bank of England announced last Wednesday that it would buy £65million worth of long-dated gilts over a course of 13 days. By buying government bonds, the BoE injects money into the market, increasing the supply of money and thus decreasing interest rates in order to reverse the increased interest rates caused by the tax plan. However, this is only a temporary solution to the problem as the BoE plans on selling gilts meaning that interest rates may rise up to 6% next spring from 2.25% today. This is in order to fight the problem of inflation, which is currently too high in the country; a heightened interest rate will incentive people to save money and thus to decrease inflationary pressure.

source: trading economics

However, the government finally gave in. Due to worldwide backlash, Kwasi Kwarteng announced on Monday that the plan to reduce taxes from 45% to 40% for the highest earners would be scrapped, stating “it is clear that the abolition of the 45p tax rate has become a distraction from our overriding mission to tackle the challenges facing our economy, as a result, I’m announcing we are not proceeding with the abolition of the 45p tax rate. We get it, and we have listened”, thus seemingly admitting to their wrongdoings. As a direct result, the pound quickly rose against the dollar again but the issue is still far from being totally resolved as the abolition of the 45p tax rate will only reduce the tax cut size by an estimated £2billion, there will thus still be a £43billion tax cut that needs to be funded, meaning the government still has to reassure markets that it has a solid plan to take care of this added funding.

This U-turn, though being the first step back in the right direction, represents quite the humiliating start to Liz Truss’ campaign as she claimed to be “absolutely committed” only one day prior to the announcement of the U-turn. She later took to Twitter to reinstate that her government’s focus lies on “building a high growth economy” seemingly in an attempt to turn the page and move on.

While we are writing this article, UK prime minister Liz Truss has resigned. She was forced to quit by senior party figures, saying that : "I recognize that, given the situation, I cannot deliver the mandate on which I was elected by the Conservative party. Liz Truss will become the person to hold the position of British prime minister for the shortest period of time.

Comments