By (Ascanio Cicogna, Equity Research Analyst)

Edited by (Francesco Corbellini, Head of Articles) Introduction: Demographics

Despite many environmentalists and politicians suggesting that population growth is unsustainable - claiming that if we keep growing, we will deplete our resources causing huge amounts of demand-sideinflation and the end of the world – we do not believe this is the case. The theory related to resource depletion completely neglects innovation and improvements in technology. Demographics are destiny. In this article, we wish to demonstrate the importance of economic growth, with particular focus on developedcountries. As some research seems to suggest that the effects of population growth on an economy differ depending on the economic development of the country. Overview: Why Demographics Matter?

To assess the effects of population growth on an economy, we will focus on the current economic situation in Japan - an example of a relatively developed country - who has been facing the effects of population decline for a while. Firstly, we would like to touch upon why fertility rate tends to be inversely correlated to economic development. The correlation seems to be due to the fact that as economies develop, people seem to give more importance to education, preferring to spend their money on one highly educated child rather than two less educated children. The current fertility rate in Japan is 1.36, which means they are below the replacement rate. The fertility rate drop alongside the constant increase in life expectancy is quickly changing Japan’s demographics and increasing the average population age of the country. These changes in Japan’s demographics seem to be causing Japan’s sluggish economic growth. So how do demographics affect the economy?

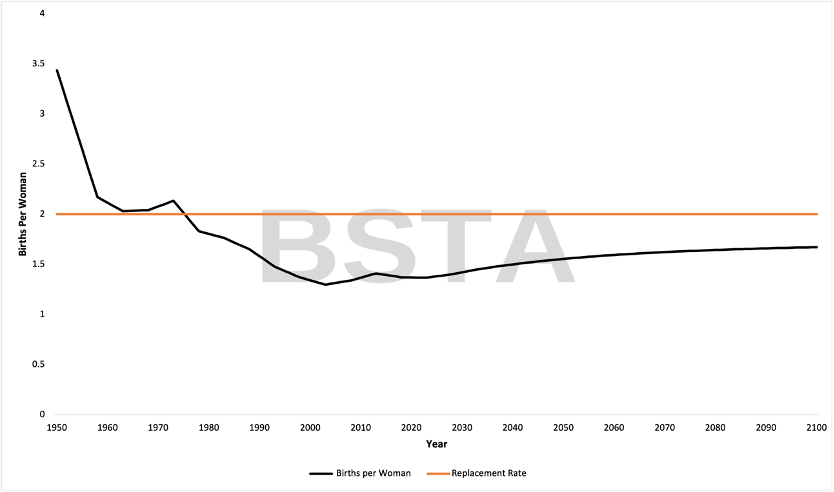

Figure 1: Japan Fertility Rate

Data source: UN World Population Prospects.

Impact: How are Demographics Impacting Japan’sEconomy?

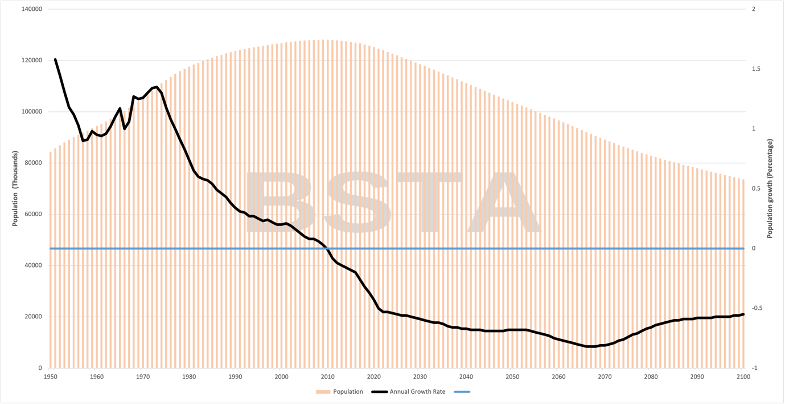

Looking at figure 1, we see that the fertility rate in Japan dropped definitively below 2 in 1975, with the annual population growth in Japan turning negative in 2010 (figure 2) -as the number of deaths surpassed the number of births in the country-. Current projections by the UN estimate that by 2050 the Japanese population will have fallen by around 17%.

Individuals over 65 will account for around 1/3rd of the population according to projections based on the current fertility rate, up from the current 28%.

Figure 2: Japan Population & Population Growth

Data source: UN World Population Prospects.

The emphasis on the statistics just mentioned should be put on the increasing amount of elderly people as a percentage of total population in Japan. We can see by looking at figure 3 that the vast majority of expenditure happens demographically between the 25 to 64 age cohorts, also known as the working age population. The spending, coupled with the output of the working age population, makes it crucial for the growth and development of a country.

Figure 3: US Average Expenditure per Age Cohort

Data source: U.S Bureau of Labour Statistics.

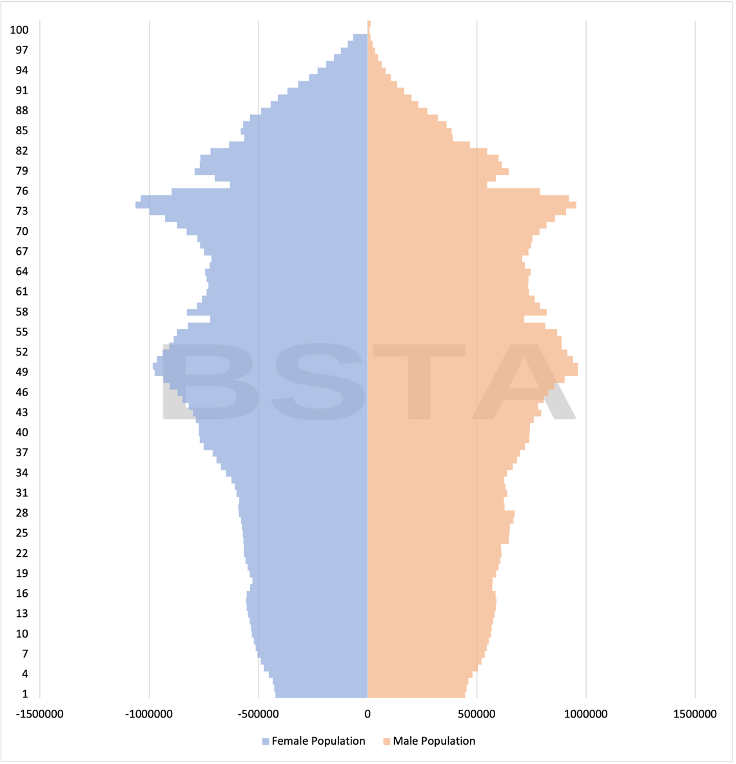

High expenditure and productivity increase government revenue through taxations. This allows the government to focus their attention on topics such as education, which further catalyse economic productivity. If working age population falls as a percentage of total population, output per capita also falls. A falling population - with an inverted population pyramid (figure 4) like Japan’s - increases the burden on younger working age populations, making it much harder for them to support the rest of the economy.

Figure 4: Japan Population Pyramid

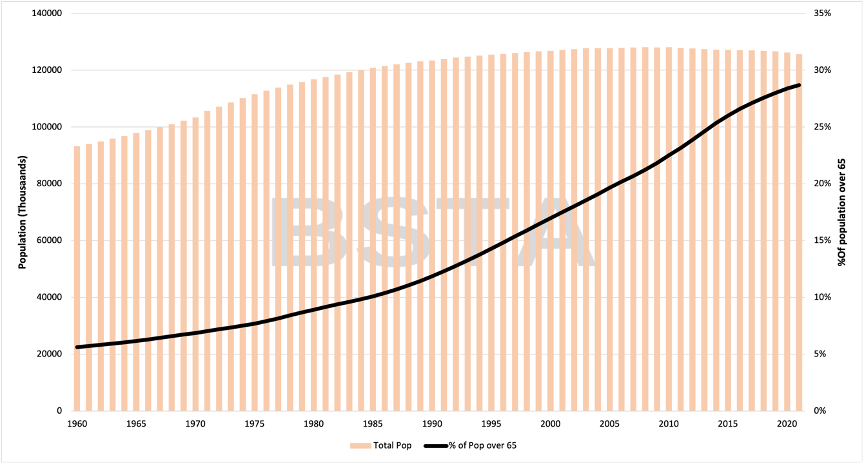

Data source: US Census Bureau International Database. In 1955, one aged person was supported by 10 working-age people in Japan. However, one aged person today is supported by two working-age people. This increase in people age 65+ as a percentage of the total population (Figure 5) in Japan causes health care service expenditure - hence the social security tax rate - to rise. The government will have to increase its fiscal budget, which can be done either through lending or increasing taxes, with both options leading to decreases in real GDP growth in the long term.

Figure 5: Japan % of Population over 65 wrt Total Population

Data source: UN World Population Prospects.

A growing elderly population as a percentage of total population - sucking out more resources from the fiscal budget coupled with the fall in working age population which lowers government revenue potentially also causing supply to fall (however, this assumes that innovation does not keep up and is outweighed by the population decline causing supply side inflation) - is the perfect recipe to shrink an economy. We cannot say that population growth is the sole determinant of economic growth, as it can be influenced by factors such as government policy, productivity of workforce, investment into technological innovation and capital machinery. However, working age population growth could be a leading indicator for future economic performance. As the saying goes, a country without children is a country without a future. These younger generations are the people who will have to innovate to support an economy that would otherwise collapse. The more brains there are the better!

For the reasons listed above, a decrease in the working age population will ultimately lead to a fall in economic growth. Looking at figure 6 we can see that around the same time fertility rate dropped below 2 (figure 1), real GDP in Japan looks to have started falling yoy.

Figure 6: Japan Real GDP Growth yoy

Data source: OECD.

This fall in real GDP growth yoy in Japan has not gone unnoticed and seems to be directly correlated to the fall in interest rates (figure 7) - an attempt from the central bank to artificially prop up investment and counteract the effects of the falling working age population. This link between falling working age population and interest rates might suggest that the use of interest rates as a way of boosting economic performance could become an ineffective method for central banks to recover from recessions for countries with a declining population.

Figure 7: Japanese Central Bank Rate

Data source: OECD.

Conclusion: Summary

In conclusion, a fertility rate below 2 - hence a declining working age population - coupled with increasing life expectancy, means less government revenue while also requiring more government expenditure to support the growing percentage of elderly people. This means that government expenditure will surpass government revenue, leading to a rising fiscal deficit forcing the government to take on more debt. This places the country in a continuous downward spiral of falling real GDP growth yoy, potentially leading to even lower fertility rates, as they seem to be correlated with consumer sentiment.

References:

Bureau of Labor Statistics. (2016). Preliminary multifactor productivity trends (2015, USDL- 16-0881).Washington, DC: U.S. Department of Labor.

Otsu, K. (n.d.). Dr Keisuke Otsu. School of Economics - University of Kent. Retrieved October 1, 2022, from https://www.kent.ac.uk/economics/people/3283/otsu- keisuke#research.

Peterson, E. W. F. (2017). The Role of Population in Economic Growth. SAGE Open, 7(4).https://doi.org/10.1177/2158244017736094.

TY - JOUR T1 - Asset Returns and Economic Growth A1 - Baker, Dean A1 - De Long, J. Bradford A1 - Krugman, Paul R JF - Brookings Papers on Economic Activity VL - UR -https://muse.jhu.edu/article/191324.

Ron Rimkus, C., 2022. The Japanese Debt Crisis (Part 2): When Does Japan Cross the Event Horizon?. [online] CFA Institute Enterprising Investor. Fromhttps://blogs.cfainstitute.org/investor/2012/04/20/the-japanese-debt-crisis-part-2- when-does-japan-cross-the-event-horizon/

댓글